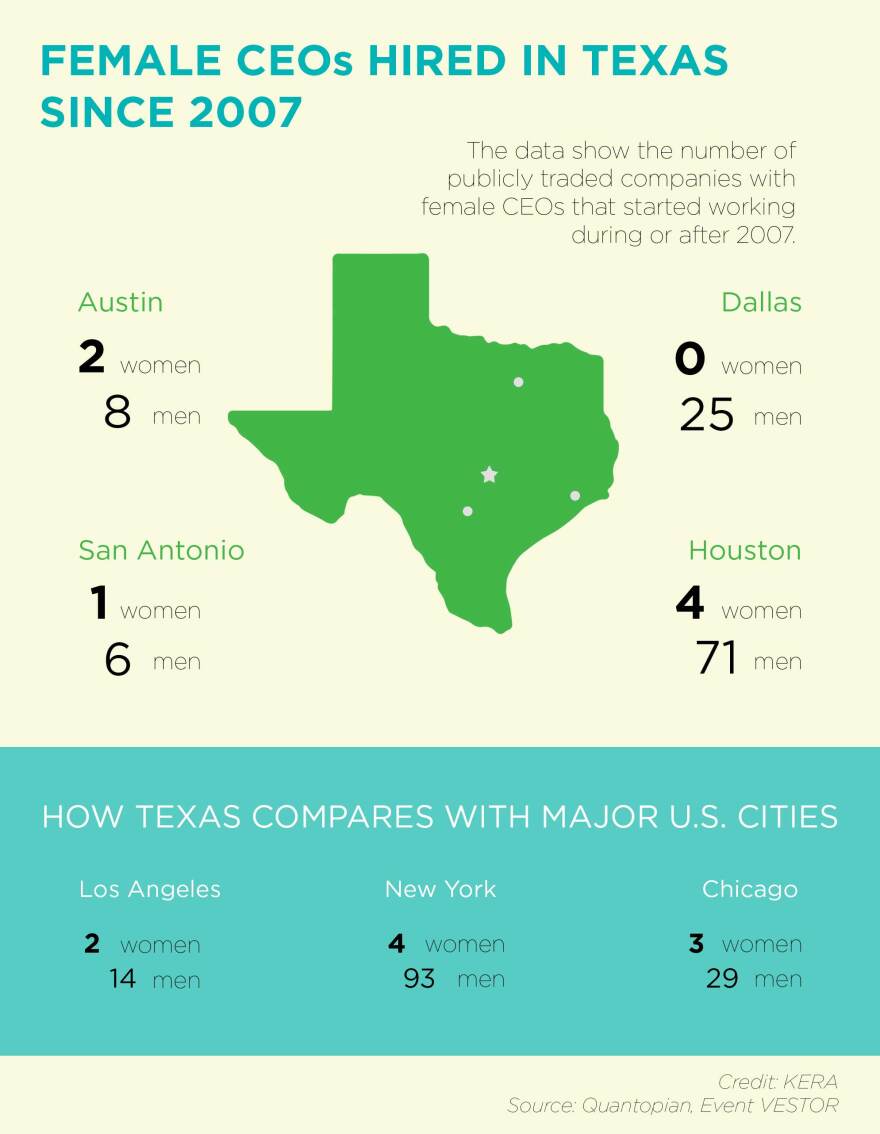

You know those lists that come out every year ranking the highest paid CEOs? Well, one from North Texas caught our eye: there was only one woman in the 100 top paid public company CEOs.

The data, from The Dallas Morning News and Longnecker & Associates, raised two big questions: first, is Texas an anomaly? And second, does it matter for investors if women make it to the C-suite?

Pam Patsley is used to being both a powerful and petite woman. When we meet in a 15th-floor conference room in Dallas, the first thing she does is adjust the height of her chair so her black ballet flats reach the ground.

Patsley became CEO of MoneyGram International – one of the world’s largest cash-transfer firms – in 2009, right after the financial crisis. Her job was to steer the behemoth to safety, all $1 billion-plus of revenue and 300,000 locations – and she did.

She says her previous experience as CFO and CEO of two other other Dallas-based financial companies helped.

In January, after six years at the helm, she stepped down to serve as executive chairman of MoneyGram.

Patsley didn’t come from a family of business people -- she’s the daughter of two schoolteachers from St. Louis – but she says she’s always wanted to be successful.

“[I] was more driven less about position but just really about achieving and earning money, to be perfectly candid,” she says.

Patsley didn’t dwell on being a female CEO, nor ranking as one of the highest-paid women executives in 2009. Still, when she saw her name on the 2016 list of top-paid public company CEOs in North Texas, she was surprised.

“I was surprised there was only one woman on the list,” Patsley says.

Maybe she shouldn’t have been.

In the S&P 500, there are only 22 female CEOs -- that's about 4.4 percent.

Elissa Sangster, executive director of the Forté Foundation, says that low percentage is being reflected in North Texas. Her Austin-based organization seeks to put more women in top-tier business careers.

“I think everybody thinks this problem is solved and you see evidence in the media that there are a lot of women leaders out there," Sangster says. "But it’s not reflected in the business world in those top CEO spots.”

Sangster says having women running companies isn’t just about equality. It’s good for business.

“There are many research studies and cases that have been made for why having more women in leadership makes a difference in your corporation’s overall return on investment your return on equity,” Sangster says.

Really? Good for the bottom line? Entrepreneur Karen Rubin was skeptical.

She’s product manager with the Boston-based trading platform Quantopian. She ran a simulation investing only in publicly-traded, women-led companies from 2002 to 2014.

“And it outperformed the S&P 500 pretty dramatically,” Rubin says. “With 200 percent greater gains than the S&P 500 over the same time period.”

Rubin was shocked.

“I’ve spent a year-and-a-half now trying to disprove it, to understand if there’s a fallacy in my thinking or the code I wrote," she says. "I have not been able to find something that completely disproves it yet.”

Still, you can’t stick a woman in the CEO spot and expect profits to magically rise. In fact, a study by the Peterson Institute for International Economics shows one female figurehead isn’t enough.

In the research, profitability only went up when multiple women were in corporate leadership – but that was for companies that went from having zero women leaders to a 30 percent share.

If Fortune 500 companies want to groom women for these top jobs, Sangster says they need to reach them at the very start of their careers.

“Instead of having this mysterious career path they’re showing them the step-by-step ways to make it to the top,” Sangster says.

Some parting advice from a woman who has made it -- Patsley with MoneyGram. She says find something you’re passionate about, work hard, and don’t be afraid to adjust a few chairs.