Spending a couple of hundred dollars on a tax preparer can eat into a refund, and keep a family from finding stable fiscal ground.

That’s what the Volunteer Income Tax Assistance program is there to prevent. Thousands of North Texans rely on what’s known as VITA.

Tax season can make even the strongest among us a little squeamish. Keeping track of all those W2’s and 1099s—tallying credits and deductions--- plugging it all in, and then the moment of truth. Will you owe, break even or get some money back?

Moment Of Truth

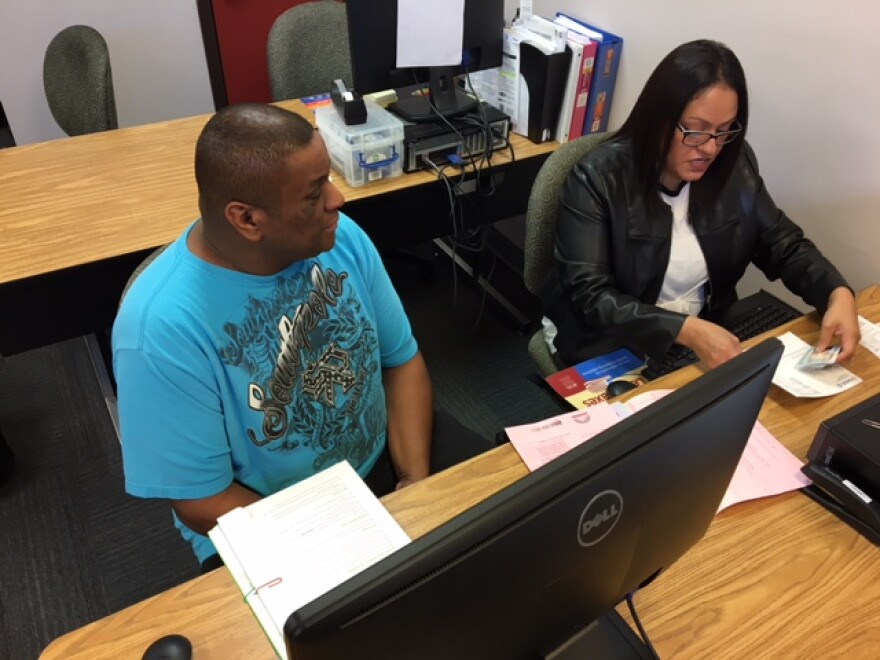

For Brodney Benson it’s the latter. He's getting a small refund, $234. He’ll take it.

“That’s going to be a help yeah. It’ll help with something. Every little bit helps," he says.

Benson lives in Fort Worth and works as a school bus driver. He lives paycheck to paycheck—so he says buying software or hiring a tax professional isn’t an option for him. A free service like VITA, is.

“Did this about three years ago and they treat you good. And when you don’t have money to go pay these big folks, it helps out," he says.

Help Is Out There

By the end of tax season, about 3,500 people just like Benson will use one of the VITA sites in Arlington. There are other sites in Tarrant County-- and Dallas and Denton County too. Find your VITA site here. Volunteers prepare returns for households making less than $54,000 annually.

“We’re all, and I include myself, we’re all one paycheck away from a crisis," says Maricela Avila, program coordinator for the Arlington sites.

She’s also qualified to prepare returns. She says many people who come in qualify for the Earned Income Tax Credit—an incentive for working families. If so, their refunds can be hefty.

“A range between, depending on the size of the family, between $5,000 to $10,000," she says.

And to family on the financial edge, $5,000 can be life-changing. Especially when it comes to security and stability.

“It means possibly paying off your rent for the next six months, and then you're safe for the next six months at least," she says.

30/40/30

The United Way runs the VITA program and recommends a 30/40/30 approach to refund spending. Using 30 percent to pay down debt—40 percent for whatever you need, even fun--- and the remaining 30 percent to invest or save. That means buying savings bonds or even starting an emergency fund.

Once a VITA volunteer finishes preparing a return, a second person double checks it. Once it’s printed out, they go over it with the filer, line by line. Explaining the process and answering questions is a big part of what VITA stands for.

“We’re going to give the client all of their credits they’re entitled to, we also educate them while they’re here, if we see something they’re doing incorrectly as far as withholdings on their W4, educate them a little bit," says Avila.

After filing, Brodney Benson wonders why his refund wasn’t bigger. Avila clarifies: he made $2,000 too much to claim the Earned Income Tax Credit in 2016.

Asking Questions, Getting Answers

While he may be a little disappointed his refund isn’t larger, he’s already made plans for the $234 that’s on the way.

“Pay off some other bills! Not many, but," he laughs.

Thanks to VITA, that’s money in his pocket—instead of money out the door to a tax preparer.